Housing, Leverage, the Dollar and Purchasing Power

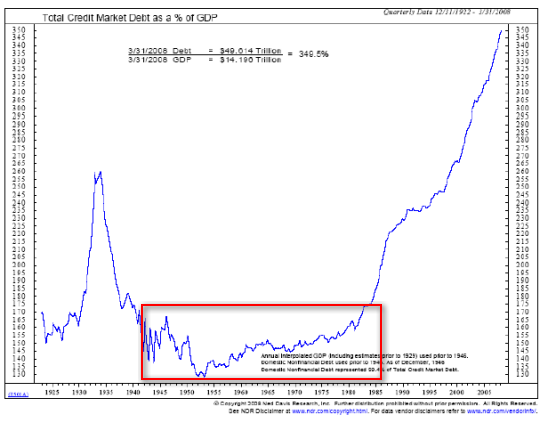

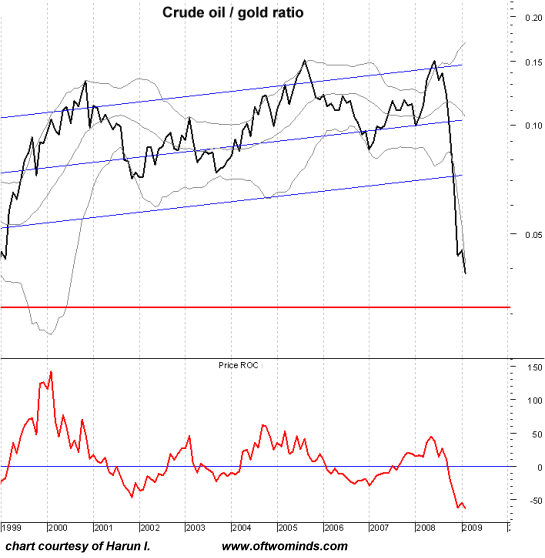

Leverage is great on the way up and catastrophic on the way down. Astute reader Scott pointed out that comparing housing to gold on a cash basis missed real estate's key feature to the average homeowner: the leverage provided by a mortgage. (When Housing Is Priced in Gold September 23, 2009) That is indeed a critical advantage when housing is rising--and a freight train slamming equity on the way down. Here are Scott's insightful comments: First: your article seems to presume that everyone buys homes in cash and never has a mortgage. Almost no one can do that. Most people have a mortgage, and therefore they have LEVERAGE (against the bank)—the homedebtor gets all the gain (or suffers all the loss, normally) of any house price change. So when I bought a house in 2002 and sold in 2007, did I lose money because the valuation went down in terms of gold? NO! When I bought a house for X and wrote a check for about .05X and paid in about another .10x and then sold it, I came out with a check for about .7X, a 360% gain. Did gold nearly quintuple? No, I think it about tripled. Could I have put X into gold and gotten .7X in gain? No, I only had .05X (and later another .10X) to put in, had I not bought a house. (And, I’d still have to live somewhere.) Would a bank have loaned my a full .95X so I could put it with my .05X and buy 1.0X of gold? NEVER!!!! So even though my house price fell in terms of gold, I didn’t much better in the house. (If houses get cheap enough, and gold holds, perhaps I will be able to exchange my gold for a cash-house, in which case the direct price ratio may have direct relevance. Yay!) (Precisely the reason why all the banks nearly failed, and some are still failing, is because all this leverage in favor of homedebtors was AGAINST the banks (and banks’ future homedebtor customers)—ESPECIALLY when homedebtors started to foist the leveraged LOSSED off themselves and onto the banks through default.) The second problem with the topic of the article is that gold is a volatile commodity, NOT a measure of basic purchasing power. Is gold at the “right” price now, relative to something we all NEED, say, food or energy? Was it the right price in 1988? 2002? 2006? You only “make” money in gold if its price is rising RELATIVE to things you’ll someday need to buy. If it only tracks such prices, it’s just a store of value, not an investment. If it lags such prices, even if it is also rising, you are losing wealth. No one NEEDS to own a house, or gold. They do need food and energy. So if you put together a graph that takes into account the leverage of home loans (mitigated, perhaps by the tax and maintenance expense) and another graph or the same graph that takes into account prices of vital goods and services (not just the flawed/understated CPI) I would be truly enthralled. Thank you, Scott. While I cannot conjure up that particular chart, I do have a few others which might be relevant. Let's start with a chart of nominal U.S. housing prices, 1970 to 2009: Judging by the substantial rise during the bubble and the modest decline from bubble heights, we might conclude that homeowners still had plenty of equity: Oops--household equity has dropped to levels not seen since the mid-1970s.So the net result of the housing bubble on actual household wealth has been negative--unless you count the $5 trillion extracted in mortgage re-fi's and home equity lines of credit. And what did homeowners get of lasting value for that $5T? I don't have the answer to that, but this chart reveals that homeowners with negative equity ("underwater") are rising dramatically. Studies have supported the common-sense idea that people with negative equity walk away from their mortgages at a far higher rate than those with substantial equity. Indeed, the "cure rate" of those who fall behind in their mortgages and then get current again is an abysmal 3-6% for all mortgages--including prime. Next up: what plentiful leverage has wrought: The red box highlights historic averages of total debt to GDP from the end of the Great Depression to the mid-1980s when the Reagan Era ushered in vast increases in deficit spending, financial "innovations" and increased leverage (the S&L debacle, etc.). As for gold being a volatile commodity: all commodities are volatile. There is no one trade, store of value or metric which will retain purchasing power in the face of fluctuating commodity, currency and asset prices. Housing has done no better or worse than gold, depending on the time-frame you select. As an exercise, let's price oil in gold: As gold rose in value this year and oil dropped, the ratio fell to levels not seen since the bottom in oil prices in the late 1990s. My point is simply that there is no asset--housing, gold, oil, dollars, wheat, etc.--which is guaranteed to retain purchasing power in a world of volatile assets, commodities and currencies. If there is one conclusion to be drawn from the above charts, it's that leverage is deadly once the bubble pops, and housing has been a disastrous "investment" for tens of millions of households who have seen their equity destroyed by a leveraged bet that "housing only goes up." True--until it doesn't. The same can be said of every asset. Next up: Walt H. on the dollar: Our current money system is much better. It allows any asset to back the currency. When money is "created" out of thin air by banks, and lent against collateral, that money is essentially backed by the collateral. The debtor must obtain dollars, or lose his collateral. Thus, we get a demand for the currency, all because of the millions of civil contracts like mortgages, commercial loans etc. that keep demand for the currency high. Amazing. Amazing that no one seems to understand this, yet, it's a perfect, and only explanation for why the dollar is not already waste paper. Like any system, it can be mismanaged, and by allowing lending in excess of the value of the collateral (accounting for risk) the system has broken down. But this could occur with a gold backed currency just as easily. Who is going to be doing the accounting on the gold vaults? On the amount of currency in circulation? That's right, the same corrupt politicians, regulators and bankers who caused the current mess. I close with a comment by Harun I. on the intrinsic difficulties of managing capital assets to retain purchasing power. "We have met the enemy, and he is us." Please read Hedge Funds and The Pareto Principle (February 19, 2007) for context. It has been my experience that nearly all of the people I know and have met have no idea what to do with their money. Doctors, lawyers, engineers, government officials and even money managers, all have no clue what to do with their money. Multi-million dollar lottery winners are broke in short order. People in entertainment routinely die broke. Bubbles come and go as they all chase the dream of something for almost nothing. It is not under-education or an inability to think critically which part people from their money, it is their uncontrolled emotions. Faced with purchasing a house which they know is unaffordable or choosing to rent they will not bother to run the comparison as long as it is their dream and "someone" told them they could. Had grumpy old Mr. Critical Thought been allowed to show up and run a spread sheet or put the numbers into Quicken they (the cold, emotionless reality of the numbers) would have irrefutably deprived them of their "dream". This drama plays out everyday at different levels across the spectrum of human psychology, the food you should not eat because you are morbidly obese, the years-old but never used exercise equipment in the garage, the spouse or partner who is abusive but you can't leave, the dress, shoes, house, boat, car you have to buy but cannot afford, the candidates we vote for because we like the way they part their hair. The inconsistencies, contradictions and convolutions are endless and mind-boggling to the point of madness to the observer. "Your book is truly a revolutionary act." Kenneth R. Thank you, Thomas F.F. ($20), for your delightfully generous donation to this site. I am greatly honored by your support and readership.I enjoyed your article and I’m all for checking prices in terms of gold, and I hold gold and hope that house prices get even cheaper, BUT, your article has a couple of key missing aspects. (Not flaws, just uncovered relevancies.)

Gold bugs like to think that the dollar must be backed gold. In other words, they want South Africa, Australia and Russia to be the richest countries on Earth.

Pareto's curiosity was sparked by the fact that the greatest amount of wealth was in the smallest number of hands. His observation boiled down to: If you gave everyone in a society one dollar, eventually 80% of those dollars would wind up in the hands of 20%. And of course out of that 20%, 4% would hold 64% of the dollars. In this sense Nature's capitalism is always at work. Money moves from poor managers to strong managers. Strong managers put that money to use by investing in plant and capacity which puts people to work. Albeit imperfect and prone to greed, when left alone it works better than socialism.

Permanent link: Housing, Leverage, the Dollar and Purchasing Power

I've been invited to join the writers contributing to Seeking Alpha. You can also find my work on AOL's Daily Finance.

If you want more troubling/revolutionary/annoying analysis, please read Free eBook now available: HTML version: Survival+: Structuring Prosperity for Yourself and the Nation (PDF version (111 pages): Survival+)

Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle